Current St Louis Tax Breaks & Rebates

Spire High-Efficiency Rebate – Laclede Gas

Who: Spire Customers

When: No End date listed as of now

What: Owners of, or customers living in, an individually metered dwelling unit, are eligible to participate in this program and must apply for rebates through the Company or through participating heating, ventilation, and air conditioning (“HVAC”) contractors. Individual dwelling units, as determined by account number, whether owner-occupied or rental property, are eligible for a maximum of two heating system rebates

Residential Rebate Form (Fillable)

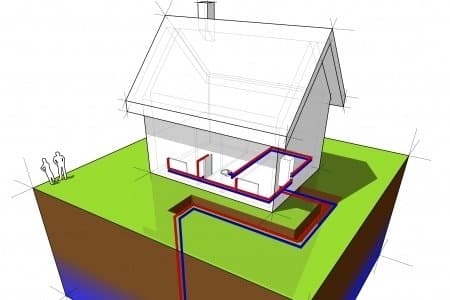

Geothermal Tax Credits – Reinstated

-

Who: Anyone who installs a Geothermal Heating & Cooling System in their home.

When: Geothermal system placed in service from 1/1/22 through 12/31/32.

What: The tax credit is 30% of the cost of the system.

LEARN MORE: Geothermal Tax Credits

Save Big with the Ameren Missouri PAYS® Program

Hoffmann Brothers is proud to partner with Ameren Missouri’s Pay As You Save® (PAYS) program — a no-upfront-cost energy efficiency program that makes upgrading your home affordable and stress-free.

-

Why Choose PAYS?

- No upfront cost — upgrades are paid through your Ameren bill

- Monthly charge < monthly savings — you save right away

- Tied to the home, not the person — benefits stay if you move

- Available for homeowners & renters (with landlord approval)

Mitsubishi IRA 25C Tax Credit Qualified ProductsUnder the Inflation Reduction Act of 2022, federal income tax credits for energy efficiency home improvements will be available through 2032. – Energy Star

FAQs About Heat Pump Incentives in St. Louis, MO

You can claim your heat pump tax credit when you file your federal income tax return the year after installation. If you have a tax preparer, make them aware of the credit and they will fill out the necessary form. If you use a program like TurboTax, it should guide you through claiming relevant energy tax credits.

The Department of Energy (DOE) will likely issue state guidelines for heat pump rebates in spring 2023 and begin funding. The DOE and the states of Missouri and Illinois will likely work together to design a program that makes rebates accessible at the point of sale, so homeowners only need to cover the remaining out-of-pocket cost.

For split-ducted and packaged units, your system must have a SEER of at least 15.2 and an HSPF of at least 8.1. For ductless systems, it must have a SEER of at least 16 and an HSPF of at least 9.5.